Property Taxes Houston Tx . this website provides information concerning the property taxes that may be imposed on your property by local taxing. General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. Visit texas.gov/propertytaxes to find a link to your local property tax database on which. When property owners pay their property taxes,. the state of texas has some of the highest property tax rates in the country. Enter your financial details to calculate your taxes. All payments must be mailed, paid online or made via the telephone. Where can i pay my property taxes? That’s nearly double the national average of 0.99%.

from www.chron.com

Visit texas.gov/propertytaxes to find a link to your local property tax database on which. General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. Enter your financial details to calculate your taxes. In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). Where can i pay my property taxes? the state of texas has some of the highest property tax rates in the country. All payments must be mailed, paid online or made via the telephone. When property owners pay their property taxes,. this website provides information concerning the property taxes that may be imposed on your property by local taxing.

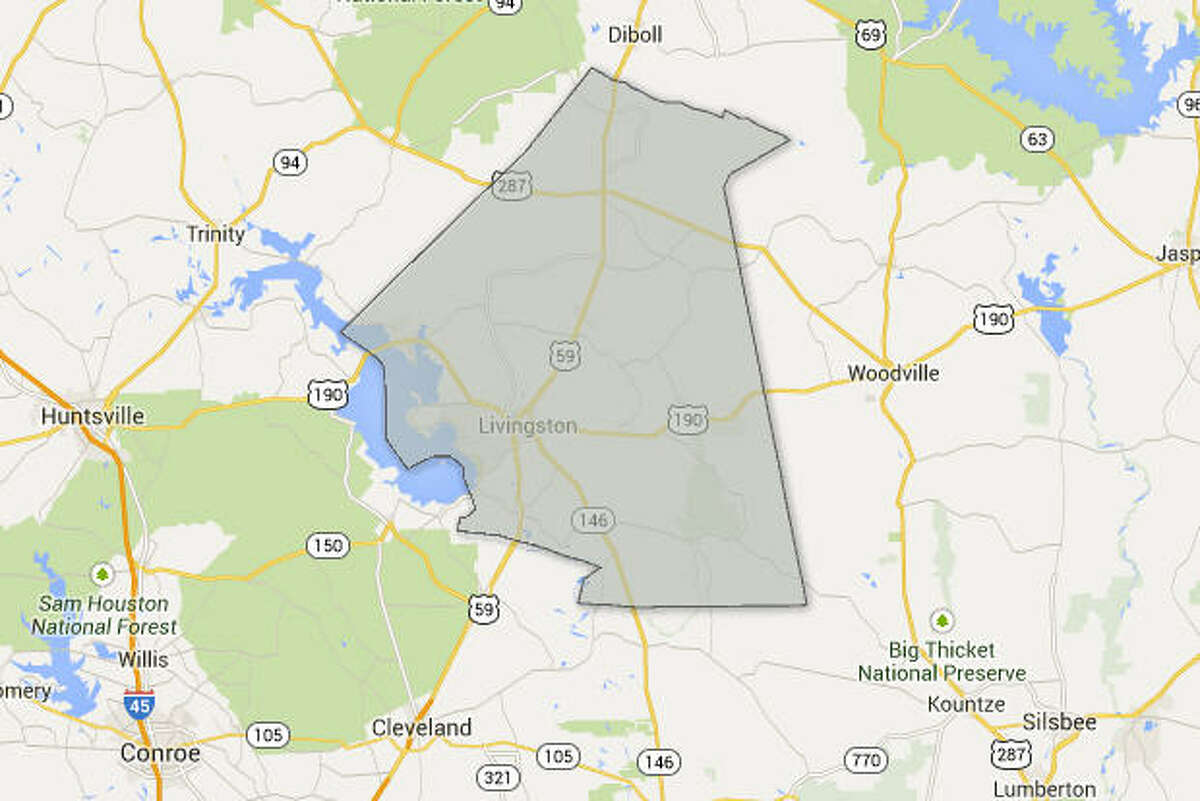

Houstonarea property tax rates by county

Property Taxes Houston Tx this website provides information concerning the property taxes that may be imposed on your property by local taxing. When property owners pay their property taxes,. this website provides information concerning the property taxes that may be imposed on your property by local taxing. General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. Visit texas.gov/propertytaxes to find a link to your local property tax database on which. Enter your financial details to calculate your taxes. That’s nearly double the national average of 0.99%. you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). All payments must be mailed, paid online or made via the telephone. In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. Where can i pay my property taxes? the state of texas has some of the highest property tax rates in the country.

From samarawheddi.pages.dev

What Is The Property Tax In Texas 2024 Bebe Marquita Property Taxes Houston Tx you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). the state of texas has some of the highest property tax rates in the country. Visit texas.gov/propertytaxes to find a link to your local property tax database on which. All payments must be mailed, paid. Property Taxes Houston Tx.

From freeprintableaz.com

How High Are Property Taxes In Your State? Tax Foundation Texas Property Taxes Houston Tx All payments must be mailed, paid online or made via the telephone. In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). Visit texas.gov/propertytaxes to find a link. Property Taxes Houston Tx.

From www.houstonchronicle.com

Your property taxes, explained Houston Chronicle Property Taxes Houston Tx Visit texas.gov/propertytaxes to find a link to your local property tax database on which. Where can i pay my property taxes? Enter your financial details to calculate your taxes. the state of texas has some of the highest property tax rates in the country. General property taxes are ad valorem taxes levied on the assessed valuation of real and. Property Taxes Houston Tx.

From patch.com

Major property tax relief on the horizon for Texas residents Across Property Taxes Houston Tx you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). Visit texas.gov/propertytaxes to find a link to your local property tax database on which. this website provides information concerning the property taxes that may be imposed on your property by local taxing. the state. Property Taxes Houston Tx.

From www.poconnor.com

Houston Property Tax Houston Home Prices Property Taxes Houston Tx Enter your financial details to calculate your taxes. In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. When property owners pay their property taxes,. you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). General property taxes. Property Taxes Houston Tx.

From www.youtube.com

Property taxes in Houston YouTube Property Taxes Houston Tx you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. Enter your financial details to calculate your taxes. the state of texas has some of the highest. Property Taxes Houston Tx.

From ceyfrfjr.blob.core.windows.net

Property Tax In Houston Texas 2020 at Thomas Butterfield blog Property Taxes Houston Tx this website provides information concerning the property taxes that may be imposed on your property by local taxing. General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). In. Property Taxes Houston Tx.

From www.texasrealestate.com

Property Tax Education Campaign Texas REALTORS® Property Taxes Houston Tx When property owners pay their property taxes,. Enter your financial details to calculate your taxes. All payments must be mailed, paid online or made via the telephone. this website provides information concerning the property taxes that may be imposed on your property by local taxing. In harris county, the most populous county in the state, the average effective property. Property Taxes Houston Tx.

From my-unit-property.netlify.app

Texas County Property Tax Rate Map Property Taxes Houston Tx That’s nearly double the national average of 0.99%. you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. the state of texas has some of the highest property tax. Property Taxes Houston Tx.

From www.chron.com

Houstonarea property tax rates by county Property Taxes Houston Tx this website provides information concerning the property taxes that may be imposed on your property by local taxing. General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. Visit texas.gov/propertytaxes to find a link to your local property tax database on which. All payments must be mailed, paid online or made via the. Property Taxes Houston Tx.

From www.houstonpublicmedia.org

Harris County property taxes for 2022 due by January 31 Houston Property Taxes Houston Tx the state of texas has some of the highest property tax rates in the country. Where can i pay my property taxes? this website provides information concerning the property taxes that may be imposed on your property by local taxing. When property owners pay their property taxes,. Enter your financial details to calculate your taxes. Visit texas.gov/propertytaxes to. Property Taxes Houston Tx.

From www.ctpost.com

Houstonarea property tax rates by county Property Taxes Houston Tx you are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement(s). Visit texas.gov/propertytaxes to find a link to your local property tax database on which. All payments must be mailed, paid online or made via the telephone. Enter your financial details to calculate your taxes. That’s nearly. Property Taxes Houston Tx.

From www.chron.com

Houstonarea property tax rates by county Houston Chronicle Property Taxes Houston Tx When property owners pay their property taxes,. All payments must be mailed, paid online or made via the telephone. In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. Where can i pay my property taxes? the state of texas has some of the highest property tax rates in the country.. Property Taxes Houston Tx.

From www.texasrealestatesource.com

Lowest Property Taxes in Texas 5 Counties with Low Tax Rates Property Taxes Houston Tx this website provides information concerning the property taxes that may be imposed on your property by local taxing. the state of texas has some of the highest property tax rates in the country. In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. Visit texas.gov/propertytaxes to find a link to. Property Taxes Houston Tx.

From www.dewalist.com

Hotel property tax Texas, Houston Property Taxes Houston Tx Where can i pay my property taxes? this website provides information concerning the property taxes that may be imposed on your property by local taxing. Enter your financial details to calculate your taxes. When property owners pay their property taxes,. Visit texas.gov/propertytaxes to find a link to your local property tax database on which. the state of texas. Property Taxes Houston Tx.

From www.youtube.com

Property Taxes Harris County How are Property Taxes calculated in Property Taxes Houston Tx In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. Where can i pay my property taxes? Visit texas.gov/propertytaxes to find a link to your local property tax database on which. General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. Enter your financial details to. Property Taxes Houston Tx.

From ceyfrfjr.blob.core.windows.net

Property Tax In Houston Texas 2020 at Thomas Butterfield blog Property Taxes Houston Tx That’s nearly double the national average of 0.99%. All payments must be mailed, paid online or made via the telephone. In harris county, the most populous county in the state, the average effective property tax rate is 2.13%. General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. Where can i pay my property. Property Taxes Houston Tx.

From www.chron.com

Houstonarea property tax rates by county Houston Chronicle Property Taxes Houston Tx Enter your financial details to calculate your taxes. the state of texas has some of the highest property tax rates in the country. That’s nearly double the national average of 0.99%. General property taxes are ad valorem taxes levied on the assessed valuation of real and personal. In harris county, the most populous county in the state, the average. Property Taxes Houston Tx.